Book A Free Consultation

Save time and ensure compliance with expert bookkeeping services

Certified, efficient,

and compliant bookkeeping services

Certified & powered by

Why outsource your bookkeeping?

How A.M.I CPA helps grow your business.

Peace of Mind

CPAs ensuring your books are accurate

Your books are always prepared in case of an audit

A CPA to call with any concerns

Take Back Your Time

Reclaim time to grow your business

Have experts maintaining your books

Have questions answered by a professional

Avoid CRA Penalties

Ensure tax law compliance is maintained

Expert accountants to help in the case of an audit

What's included with our bookkeeping services

All great businesses have properly kept books.

Payroll

Employees paid on time

Tax & other deductions correctly calculated

Accurate pay stubs and T4s

Guaranteed CRA compliance

Tax Filing Ready Books

Monthly bookkeeping entries

Prepared financials for T2 filings

CPA certified accuracy

Guaranteed CRA compliance

AP & AR Management

Ensure all invoices are paid on time

Pay suppliers before the due date

Ensure AP are fuelling business growth

Guaranteed CRA compliance

Our other business accounting services

Need ongoing and actionable financial insights? Explore our other business accounting services!

Fractional CFO

CPA prepared budgeting

Ongoing financial insights and reporting

Track your financial KPIs

Have an on-call CPA for your business

Tax Preparation

Optimize your corporate taxes

T2 preparation and filing with the CRA

CPA prepared and certified filing

Tax planning for your business

Welcome To A.M.I. CPA Professional Corporation

The GTA's Bookkeeping Experts

Being a business owner is too hard to also be a full time bookkeeper! At A.M.I. CPA we take care of our clients' books so they can focus on making more money in their business.

Our bookkeeping systems ensure that when it comes time to file taxes at year-end, our clients are confident that all their books and accounts are accurate, offering a stress-free tax season.

Ahmad Amaduddin

Managing Partner at A.M.I. CPA PROFESSIONAL CORPORATION

Ready To Get Your Bookkeeping In Order?

What Our Clients Say

Some of the Industries We Serve

Including but not limited to:

doctors

multidisciplinary clinics

lawyers

trades businesses

contractors

electricians

Real estate Companies

holding companies

dentists

trades businesses

contractors

electricians

Real Estate companies

holding companies

dentists

You ARen't the first to ask these

Frequently Asked Questions

Why should I outsource my bookkeeping

Peace of Mind

To give you peace of mind, a good bookkeeping service will help you focus on your business while they focus on the numbers.

Scalability

Hiring an outsourced bookkeeping service with controller oversight and a full-service offering enables the service to scale to needs without hiring or training additional staff.

Training

Most business owners are not in the position to be able to train or manage bookkeeping staff–primarily because their bookkeeper likely knows more about it than they do. However, the benefits of having a bookkeeper with up-to-date comprehensive knowledge of tax rules or reporting methods make a big difference in the quality of bookkeeping.

Maximize Resources

When business owners try to save money by doing their own bookkeeping or delegating it to another key employee, they spend valuable time and energy that could be better used growing the business. When they outsource their bookkeeping services, they free themselves up to spend their time doing what they do best.

What types of businesses need bookkeeping services?

All businesses benefit from bookkeeping, including small businesses, freelancers, startups, and corporations. It ensures you stay on top of financial obligations and make data-driven decisions.

Can A.M.I. CPA help with GST/HST filing and compliance?

Absolutely! We ensure your GST/HST filings are accurate and submitted on time, helping you avoid penalties and stay CRA-compliant.

Can A.M.I. CPA clean up old or messy books?

Yes, we specialize in organizing and reconciling historical records to ensure your books are clean, accurate, and ready for future growth.

Does A.M.I. CPA offer virtual or online bookkeeping services?

Absolutely! We offer secure, cloud-based bookkeeping solutions that allow you to access your financial data anytime, anywhere.

What is the difference between bookkeeping & accounting

Bookkeeping records daily financial transactions, while accounting focuses on analyzing and interpreting that data for tax filing, reporting, and strategic planning.

How can a bookkeeper help my business?

A bookkeeper ensures your financial records are accurate and up to date, helping with cash flow management, tax preparation, payroll, invoicing, and compliance with CRA regulations.

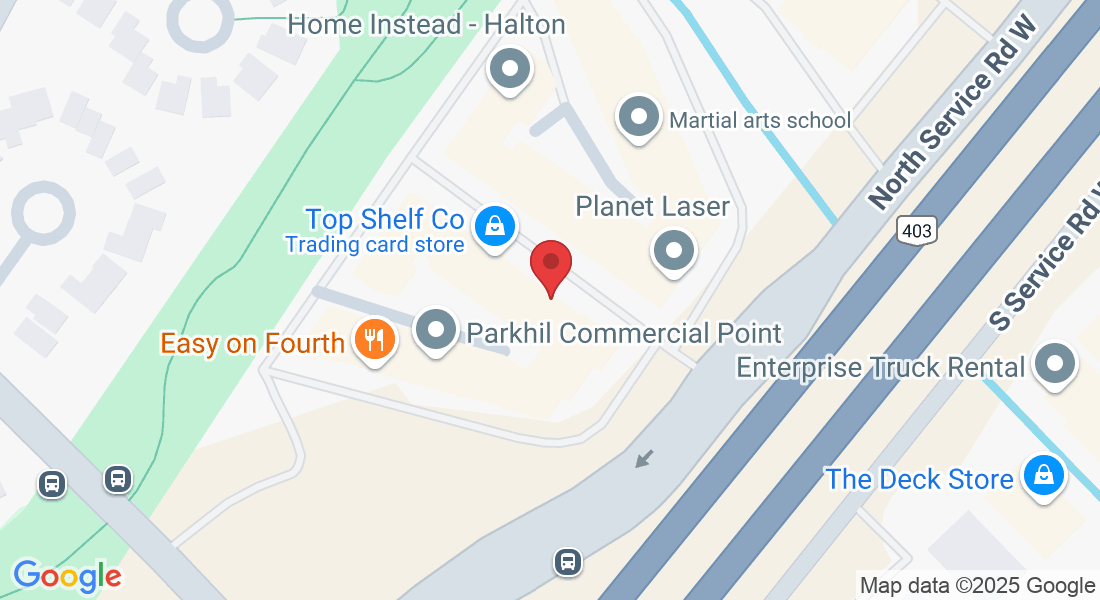

Service Areas

oakville

hamilton

Burlington

Mississauga

Burlington

Mississauga

Get started with A.M.I. CPA today!

Who Needs Our Bookkeeping Services

Small businesses (including sole proprietors)

Corporations

Franchises

Startups

All businesses

Other Accounting Services

Fractional CFO

Get a year-round financial and accounting advisor.

Corporate Tax

We handle all your corporate tax needs.